Common Trading Chart Patterns You Should Know

Chart patterns are a major part of trading and should definitely be part of your technical analysis toolkit. They help you spot trends and predict market movements, which is useful whether you’re new to trading or have been at it for a while. You can use these patterns in different markets like forex, stocks, commodities, and others.

In our guide, we break down eleven of the most well-known and useful chart patterns. Start learning about these patterns now to make smarter, well-informed trading choices later!

What is a chart pattern?

Think of a chart pattern as a familiar sequence in market prices that repeats over time. By looking at how these patterns behaved in the past, you can make an educated guess about what might happen when the same pattern appears again. Just keep in mind, though, that past performance only offers insights, it does not guarantee future results.

How a chart pattern plays out can change depending on market conditions. Whether it’s a hectic, volatile time or a more stable period, and whether the market is going up or down, can influence the direction a chart pattern will take.

Common types of chart patterns

As you explore chart analysis, you’ll generally come across three basic types of patterns:

Continuation patterns

Continuation patterns suggest that a trend will likely pick up again after a short break. Think of it as a temporary slowdown in the market’s momentum. For instance, in an uptrend, the market might take a momentary break as the bulls regroup, or it might pause during a downtrend as the bears catch their breath.

While the pattern is forming, it’s not always clear if it will keep going or change direction. It’s important to monitor how the price interacts with the pattern’s trendlines. If the price climbs over or drops under the continuation zone is a deciding factor in how things will play out. Generally, traders expect the trend to keep going until there’s clear evidence of a reversal.

Reversal patterns

Reversal patterns signal that the existing trend might be about to change direction. They show that the market may be slowing down in its present course, and a new trend could be starting. For example, if an uptrend is losing strength, the market might shift direction and start moving downward.

Reversals that happen at market peaks, where selling starts to outstrip buying, are called distribution patterns. Meanwhile, reversals at market lows, where buying starts to dominate, are known as accumulation patterns.

Bilateral patterns

Finally, bilateral patterns suggest that the market is experiencing increased volatility, which could lead to movement in either direction. They reflect a state of uncertainty, where the market might swing in one direction or the other.

Common chart patterns for trading

Now that we’ve got the basics down, let’s jump into some of the most popular chart patterns you’ll come across in technical analysis.

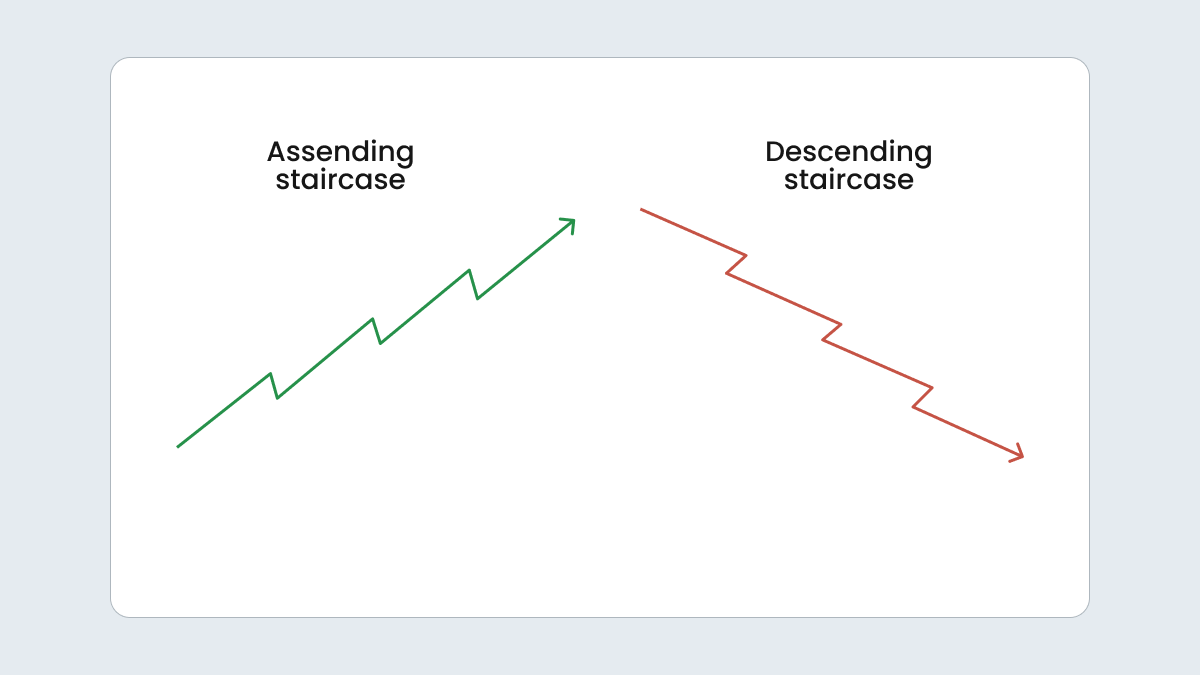

Ascending and descending staircases

An ascending staircase pattern shows a market that’s climbing steadily. Although there are occasional retracements, the overall trend is marked by higher highs and higher lows. This is the hallmark of a bull market, where traders might take long positions and enjoy the ride up until the trend shifts.

The dips along this rising trend can actually be golden opportunities for buying in at a better price before the market pushes higher again.

Conversely, a descending staircase pattern indicates a market on the decline. You’ll see the lows and highs both getting lower. In a downward trend like this, traders might look for chances to sell and use brief upswings against the bear trend to enter short positions.

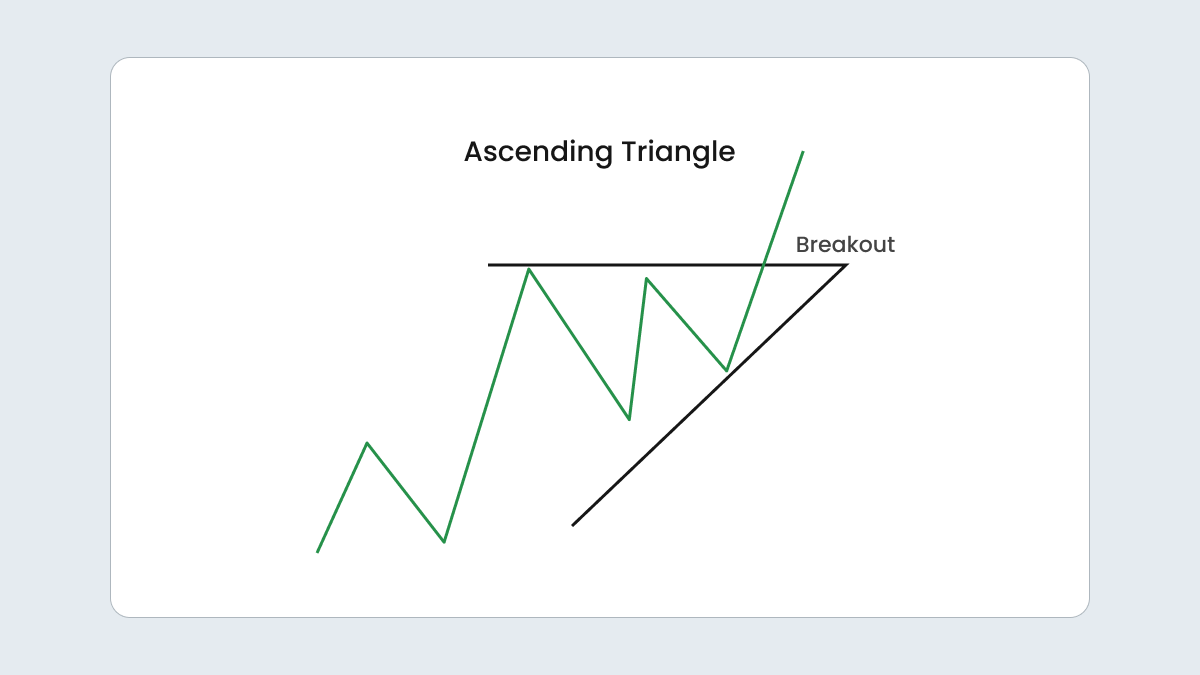

Ascending triangle

The ascending triangle forms when an asset’s highs stay roughly the same while the lows gradually rise. You can picture this chart pattern as a tug of war where the horizontal line acts as a barrier, or resistance, and the upward sloping line represents support.

Usually, this pattern appears after an uptrend and signals that the market might keep moving up. The market tends to consolidate or take a breather during this time but if the price moves past the resistance level, that often means a new upward trend is on the horizon.

Good traders should double-check this pattern before jumping in. They’ll look at volume indicators — volume might drop during the pattern, but if it surges when the breakout happens, that’s a good sign the price will continue to rise. However, if the price falls under the support level or if volume drops off, this might signal the start of a downtrend instead.

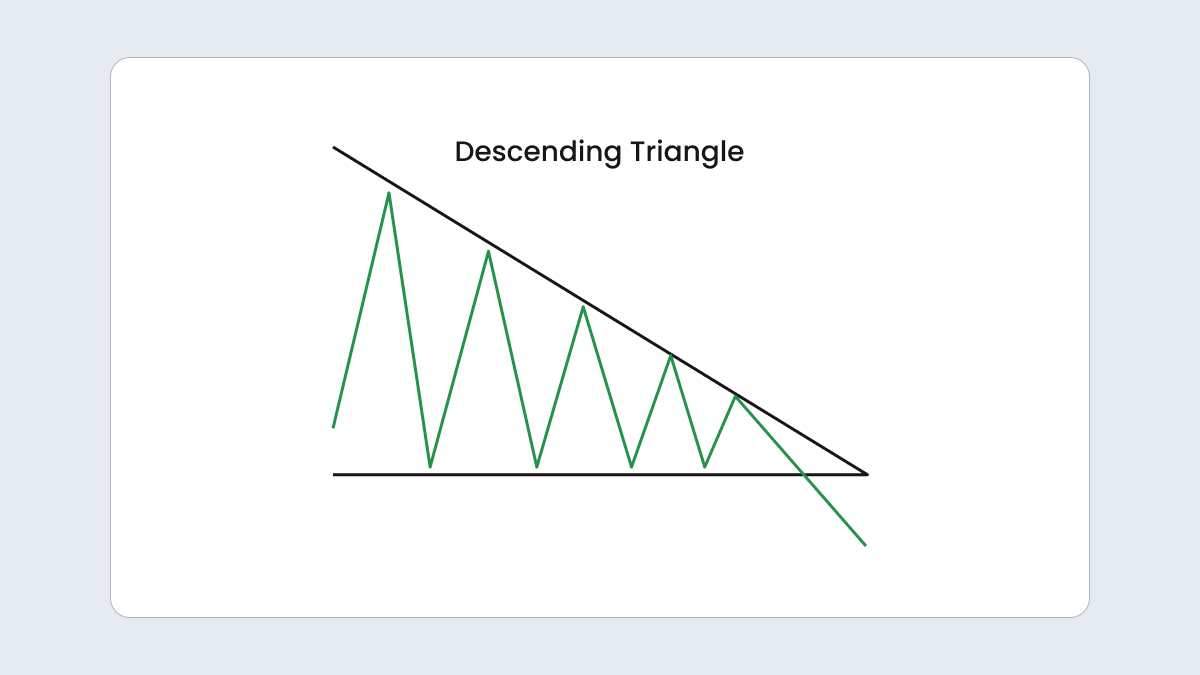

Descending triangle

The descending triangle is the reverse of the ascending one. It typically shows up after a downtrend and is formed when the market’s lows stay steady at one level (that’s the support), while the highs keep getting lower (that’s the resistance).

This pattern usually signals that the market might break through the support level and keep falling, so it’s generally a bearish sign. However, if the market manages to break through the resistance level, it could indicate the start of an uptrend.

As with the ascending triangle, a falling volume during the pattern, followed by a spike when the breakout happens, can give you a stronger signal about where the market might head next. You can then decide what to do.

| Video ↘ |

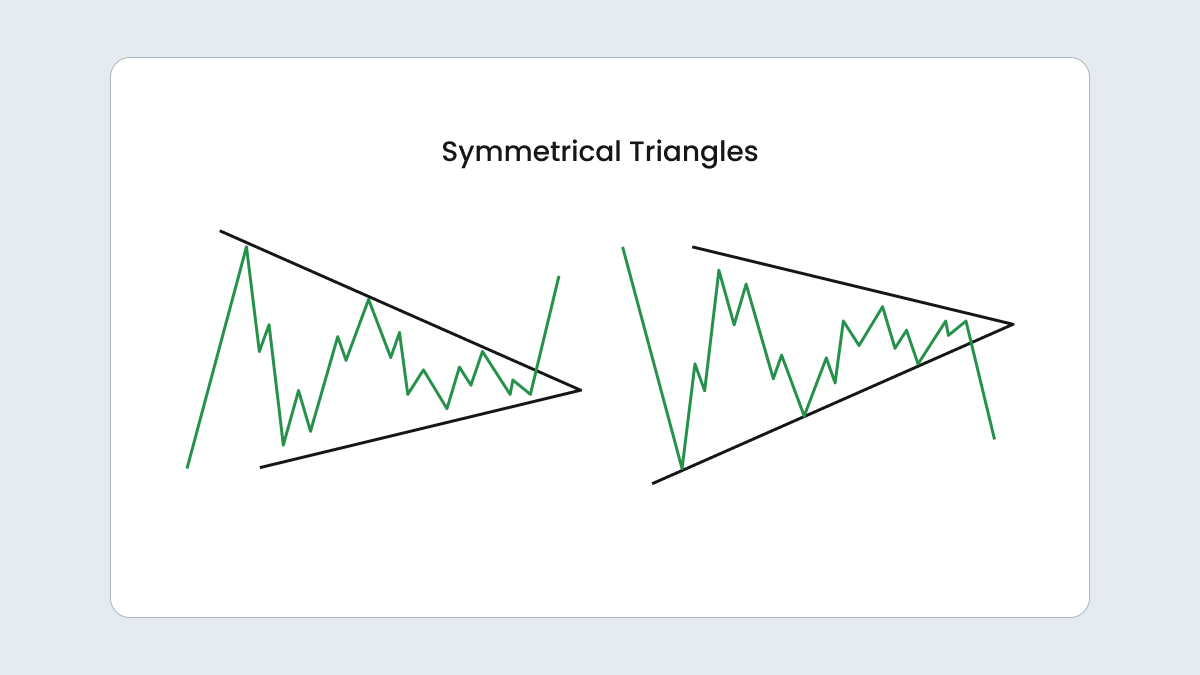

Symmetrical triangle

A symmetrical triangle pattern forms when two trend lines gradually come together. They create a shape that looks like you’ve stacked an ascending triangle on top of a descending one, without the horizontal lines.

This pattern hints at a few possibilities, depending on what the market was doing before. Often, it signals that the market is likely to keep advancing in the same direction it was going before the triangle formed. But if the market was just drifting sideways, it could go either way once the breakout happens.

When the price ultimately moves past one of the trend lines, that usually means the market will continue in the same direction. So, if you’re trading a symmetrical triangle, keep an eye out for the breakout and be prepared to jump in, depending on where the market heads next.

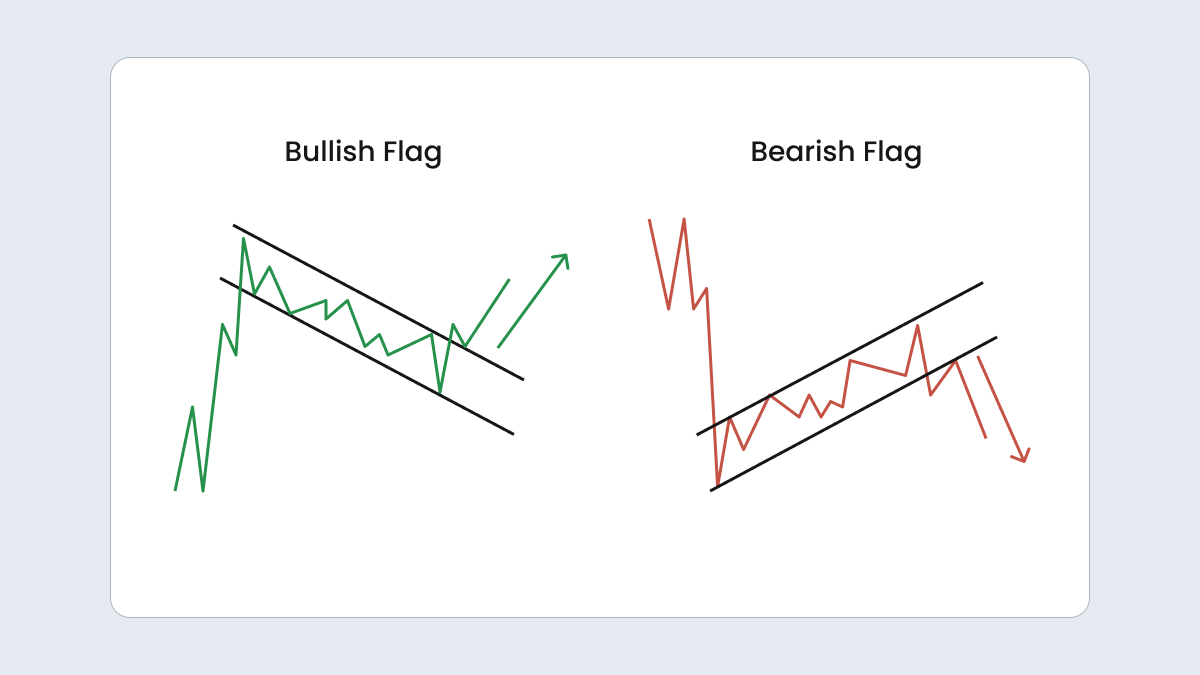

Flag

A flag pattern is a market’s pause before it makes its next big move. The flag pattern forms when the support and resistance lines run parallel to each other, either sloping up or down. This usually ends with a breakout that goes against the direction of these lines.

In a bullish flag, the lines slope downward, and when the price breaches the resistance level, it points to the start of a fresh upward trend. On the flip side, a bearish flag has lines sloping upward, and a drop below the support level means a new downtrend might be beginning.

Although the price action within a flag pattern may look like a reversal, flags are generally seen as continuation patterns. They often appear after strong trends — bullish flags after an uptrend and bearish flags after a downtrend.

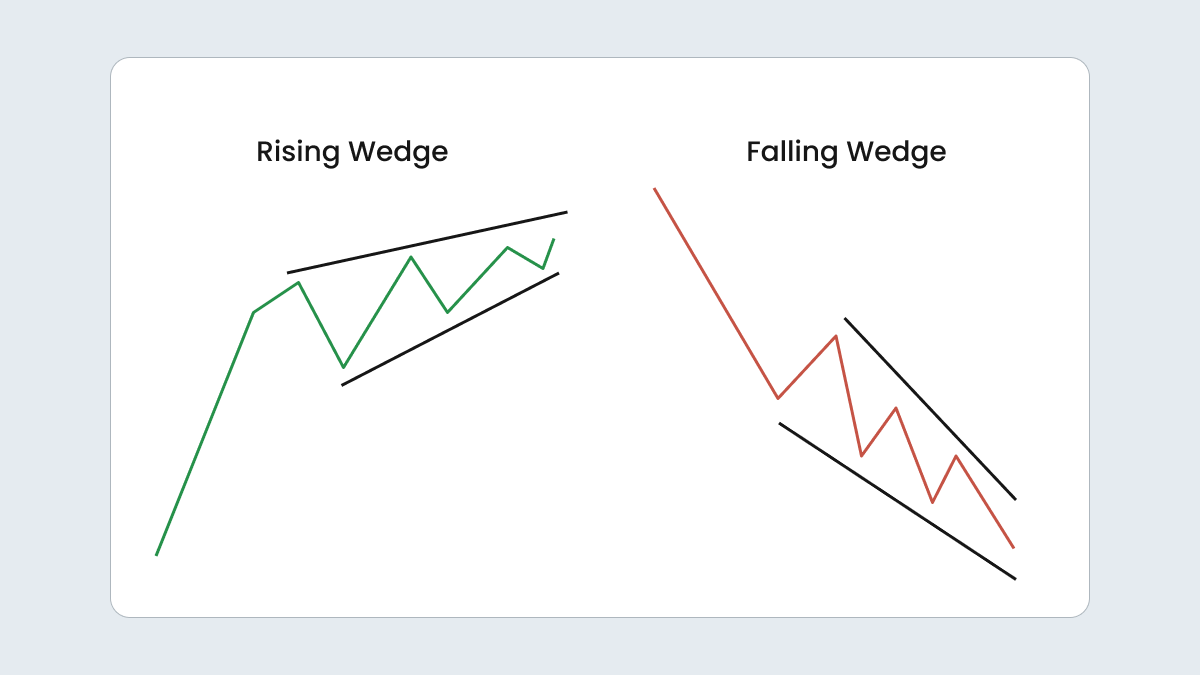

Wedge

A wedge chart pattern is a bit like a flag but with a tighter squeeze — the lines gradually converge instead of staying parallel. As this pattern unfolds, you’ll often see a drop in trading volume, adding to the anticipation of a big move.

Wedge patterns come in two primary forms: rising and falling. With a rising wedge, the market usually breaks down through support by the end of the pattern. This could be your cue to jump into a bearish trade or to wrap up a long position.

A falling wedge indicates that the price is likely to break up past the resistance point, marking a potential new uptrend. This might be the perfect time to go long or exit a short position.

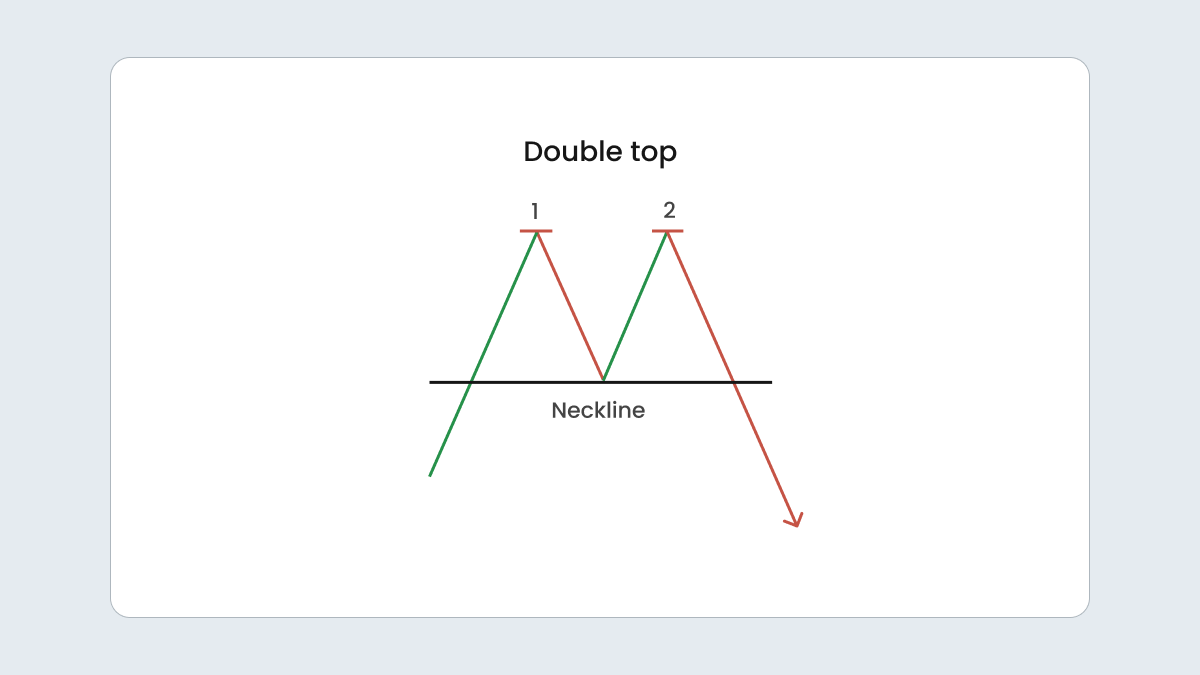

Double top

A double top pattern is the market’s way of showing it’s reached its limit. It forms when the price peaks twice with a small dip in between, creating an M-shaped chart pattern.

This is usually a bearish signal, meaning the price is likely to move lower than the support level that’s established at the low point between the two peaks. Just seeing the two peaks isn’t enough to make a solid trade decision, so it’s important to confirm this support level.

In this pattern, the market tries to push higher twice but falls short each time as sellers take over. Often, the second peak won’t quite match the height of the first, which suggests that the buying momentum is fading.

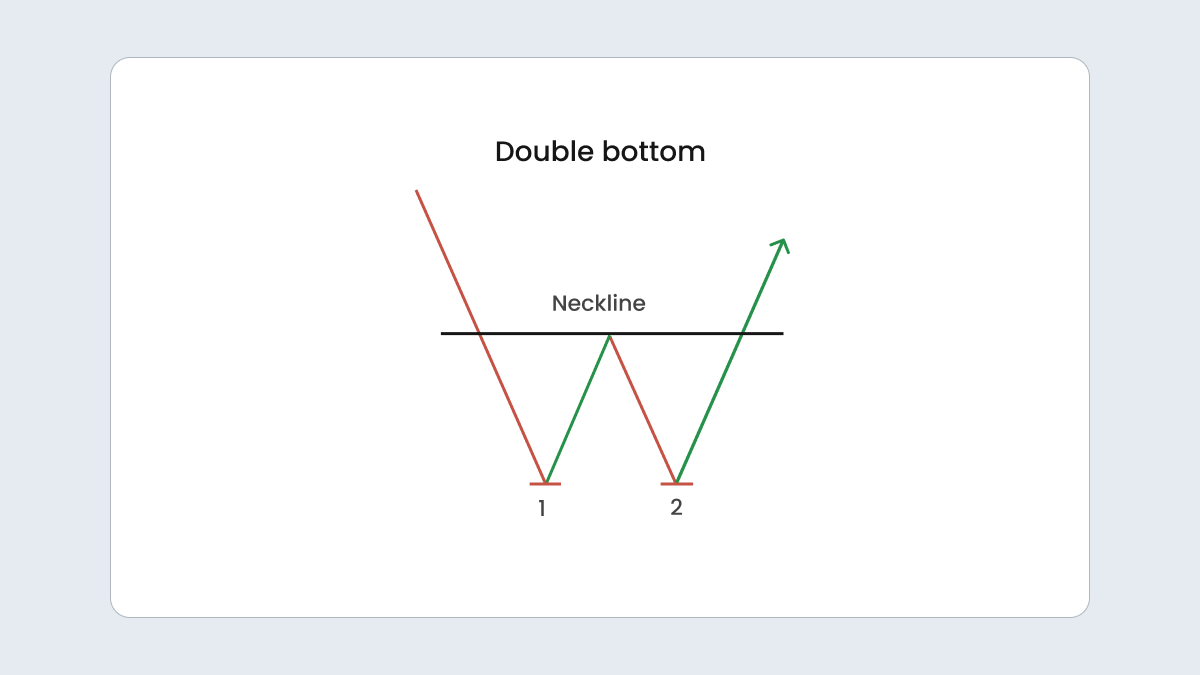

Double bottom

A double bottom is the flip side of a double top. It happens when the market price attempts to drop below a support level twice but fails both times. Between these attempts, the price temporarily rises to a resistance level, forming a W-shape on the chart.

This pattern is seen as a bullish reversal signal and suggests that selling pressure is easing and a new uptrend could be starting. So, if the price climbs past resistance, that’s a good indicator that the upward movement might continue. Here, as well as with the double top, it’s smart to confirm the resistance level before jumping into a trade through your chosen trading platform.

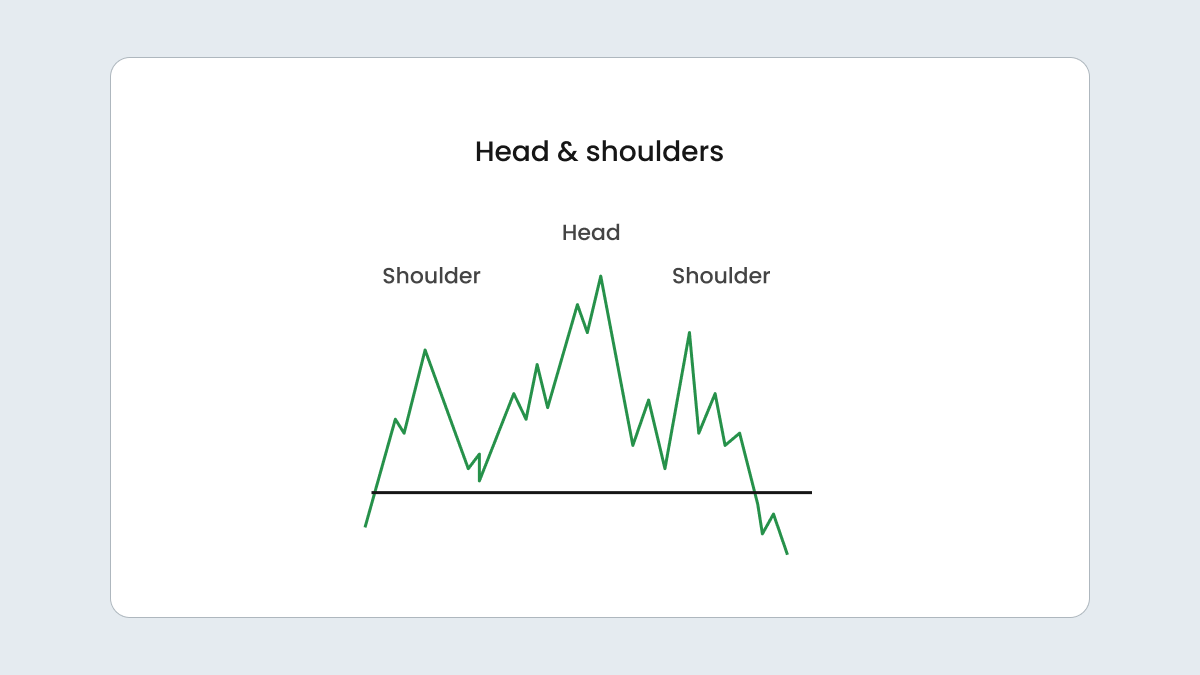

Head and shoulders

The head and shoulders pattern is a classic chart formation with a clear shape. There is a central peak, the tallest point, which is the head. On either side, there are two shorter peaks known as the shoulders. All three peaks tend to align with a support level called the neckline.

The pattern works like this: the market hits a high with the head, then pulls back before rising again to form the first shoulder. It dips again and rises for the second shoulder. But, unlike the previous highs, this third peak usually breaks through the neckline, signaling a shift towards a downtrend.

Essentially, the head and shoulders pattern suggests that the bullish momentum is fading. The market tried to push higher twice but failed to do so on the third attempt, which hints that it’s time for a downward move. This may be a good opportunity to seize the moment.

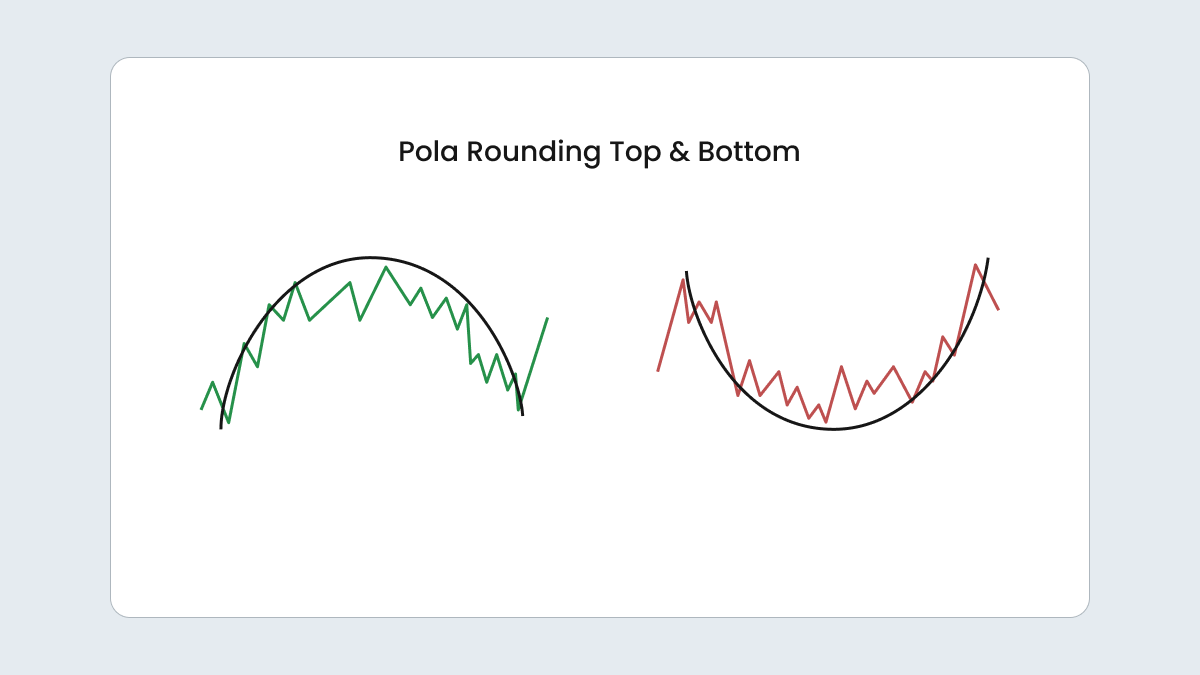

Rounded top or bottom

A rounded top, which looks like an upside-down U, suggests that the market is gearing up for a decline. On the other hand, a rounded bottom, shaped like a U, indicates that an upward trend might be approaching. Unlike the quick moves seen in double tops and bottoms, rounded patterns unfold more slowly, over a series of sessions.

In a rounded top, the market starts strong with higher highs but gradually starts to flatten and then decline, showing that selling pressure is increasing. A rounded bottom starts with less buying momentum. As the pattern forms, buying interest grows and pushes the market higher, hinting at a potential rise.

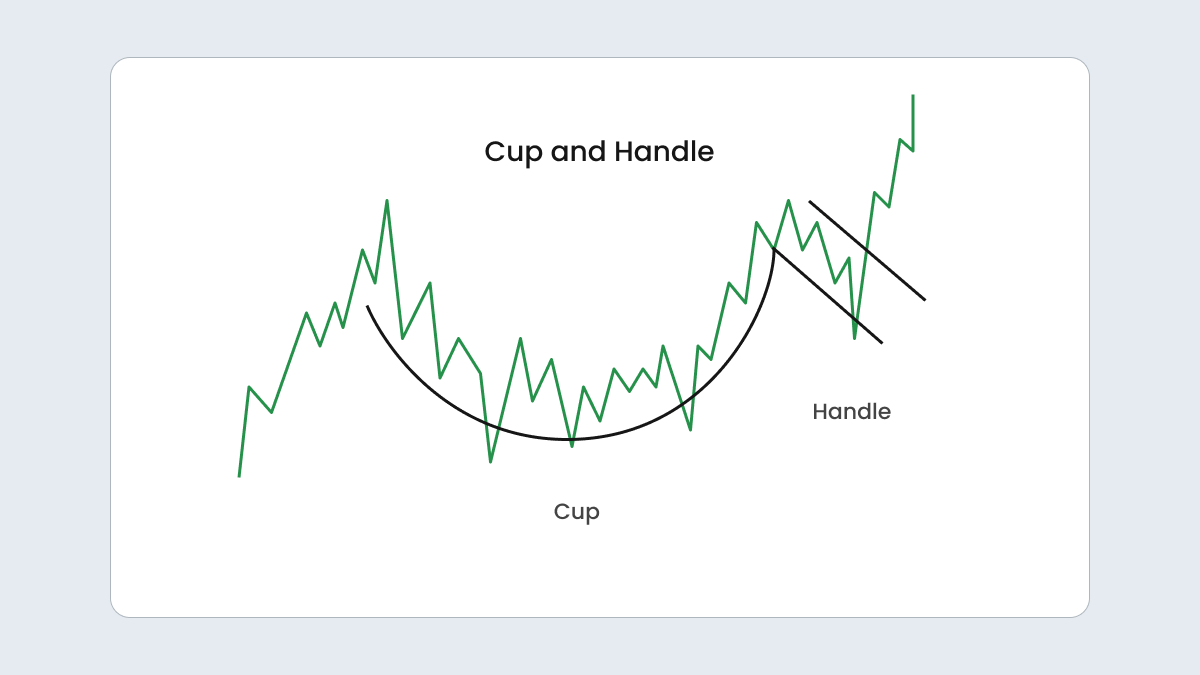

Cup and handle

The cup-and-handle pattern looks like a rounded bottom with a bit of a twist. It starts with a deep, rounded dip, followed immediately by a smaller, secondary dip. It’s similar to a double bottom with a little extra step, delaying the rise but not stopping it.

This pattern reveals a potential upward reversal. It indicates that after a bit of sideways action, the market is poised to move upward.

How to trade with patterns

The main principle is simple: you buy in bullish setups and sell in bearish ones. But remember that whether it’s a simple or advanced chart pattern, no pattern is perfect,, so managing risk is key.

Here’s how you should approach pattern trading:

Confirming a pattern

Don’t jump in right away. Wait and see if the pattern holds. If you spot a bullish flag, for instance, wait for a couple of green candles after the breakout to confirm the trend. Sure, you might miss a few points, but it’s better than taking a loss if the pattern fails.

If you need more assurance, check past price levels or use momentum indicators for extra confirmation.

Setting your stop-loss

Always protect yourself with a stop-loss. That way, you won’t lose too much if things go south.

- For bearish patterns, set the order above the last high.

- For bullish ones, place it below the last low.

For example, in a bull flag, set your stop-loss just below the support line to limit your risk.

Choosing a profit target

Know when to cash out. Determine a profit target according to the pattern’s dimensions. If your bull flag has a 50-point range, aim for a 50-point gain above the breakout.

This also helps you figure out your risk-reward ratio. If your stop loss is 25 points below, you’ve got a solid 1:2 ratio — a good balance for most traders.

Table of trading chart patterns in summary

|

Pattern |

Description |

Trend |

Signal |

Characteristics |

|

Ascending triangle |

Highs stay the same while lows rise |

Uptrend |

Bullish continuation |

Price consolidates, then breaks above resistance |

|

Descending triangle |

Lows stay the same while highs fall |

Downtrend |

Bearish continuation |

Price consolidates, then breaks below support |

|

Symmetrical triangle |

Trendlines converge, a narrowing pattern |

Either |

Can be bullish or bearish |

Price breaks out in either direction |

|

Flag |

Parallel trendlines with a brief consolidation |

Depends on prior trend |

Continuation (bullish or bearish) |

Price consolidates before resuming in the direction of the previous trend |

|

Wedge |

Converging trendlines that narrow over time |

Depends on type |

Can be bullish or bearish |

Rising wedge = a bearish breakout; falling wedge = a bullish breakout |

|

Double top |

Two peaks with a dip in between |

Downtrend |

Bearish reversal |

A trend reversal after a peak |

|

Double bottom |

Two troughs with a peak in between |

Uptrend |

Bullish reversal |

A trend reversal after a trough |

|

Head and shoulders |

A high peak in the middle with two lower peaks on either side |

Downtrend |

Bearish reversal |

Weakening bullish momentum and a potential market trend reversal |

|

Rounded top |

Gradual peak in the shape of a curve |

Downtrend |

Bearish reversal |

A slow shift from upward to downward movement |

|

Rounded bottom |

Gradual trough in the shape of a curve |

Uptrend |

Bullish reversal |

A slow shift from downward to upward movement |

|

Cup and handle |

A rounded bottom followed by a smaller dip and then a rise |

Uptrend |

Bullish reversal |

Cup indicates consolidation, with a handle forming a brief pullback before breaking to new highs |

FAQ

How many different types of chart patterns are there?

The answer depends on who you ask. Some people say there are just three types that correspond to how the price moves — continuing, reversing, or consolidating. Others might count over 70 different patterns, each with its own unique twists and nuances.

Which chart pattern is the most reliable?

It really comes down to what works best for you personally. A chart pattern can work for one trader and not work for another, so finding the pattern that aligns with your unique strategy is key.

What are the kinds of graph patterns?

In technical analysis, charts generally fall into three graph patterns. Continuation patterns imply that the current trend is expected to continue after a short break. Reversal patterns represent a trend changing direction. Lastly, bilateral patterns signal that the market could move in either direction due to increased volatility.

What do chart patterns represent?

Chart patterns are visual representations of past price movements on a trading chart. They help identify recurring trends and shapes and give traders insights into potential future price behavior.

Share with friends: